Since Brexit, the rules for moving goods between the UK and the European Union (EU) have changed significantly. Nowadays, if you're planning to take commercial samples, professional equipment, or exhibition goods temporarily across the border, you likely need a UK to EU ATA Carnet.

This guide cuts through the confusion to give you a clear, essential overview of how to use a Carnet for travel from the UK into the EU.

Crossing Borders Post-Brexit:

Do I Need An ATA Carnet To Transport Goods From The UK To The EU?

Before the UK left the EU, goods could move freely, but that is no longer the case. Now, you need an ATA carnet that acts as a passport for your goods, simplifying the customs procedures for temporary imports into EU member states. With an ATA carnet:

You won’t have to deal with standard customs declarations

You won’t need to pay customs duties and taxes (like VAT) for goods that will be brought back to the UK within a year.

A UK to EU carnet is here to help UK businesses transport temporary goods for trade shows, film and TV productions, music tours, or exhibitions with minimal hassle.

Which Goods To Transport From The UK To The EU

The ATA Carnet scheme is specifically for goods that are being temporarily exported and will be returned to the UK in the same state.

Allowed Goods

A carnet covers three main categories of allowed goods:

Commercial samples - items taken abroad to solicit orders for identical goods. This includes items you might show at a business meeting or market.

Professional equipment - tools of the trade, such as musical instruments, camera gear, medical equipment, machinery, or even vehicles used for specific purposes (like racing).

Goods for fairs/exhibitions - items intended for display or use at a trade fair, exhibition, demonstration, or similar event.

Forbidden Goods

An ATA carnet cannot be used for every type of export - you cannot use it for:

Consumable, perishable, or 'single-use' goods - this includes food, fuel, oil, promotional giveaway items, flyers, or any items intended to be sold or given away permanently abroad.

Postal traffic - goods being sent through the mail.

Goods for processing or repair - items that will be altered or worked on abroad.

Long-term exports - goods that will remain outside the UK for longer than the Carnet's maximum validity (typically one year).

What Documents Do I Need For A UK To EU Carnet

The paperwork process for securing a carnet is complex and can result in careless mistakes if done by a non-professional. You'll need to prepare a few key documents:

Itemised List of Goods

You’ll need to submit a detailed list of goods which contains details such as:

Description (e.g., “LED Light Panel”)

Make and Model

Serial Number (if applicable)

Weight (in kg)

Value (in GBP)

Country of Origin (where it was manufactured)

You need to be as accurate as possible, as Customs Authorities will cross-check this list with your goods to determine eligibility. Some categories of goods have additional requirements regarding the details you supply in your application.

Purpose of Use

You’ll need to specify the purpose of the goods you’re transporting. This can be for a:

Trade fair exhibition

Film or media production

Product demo or temporary project

Personal Information

You’ll need to provide:

Full name & the name of your company (if applicable)

Contact details

Valid passport or photo ID

Travel Itinerary

You’ll need to provide your full travel details:

Travel dates

Country of departure and destination

Entry and exit ports or airports

Carnet Wizard can help you with customs documentation, so you can be sure no detail gets missed.

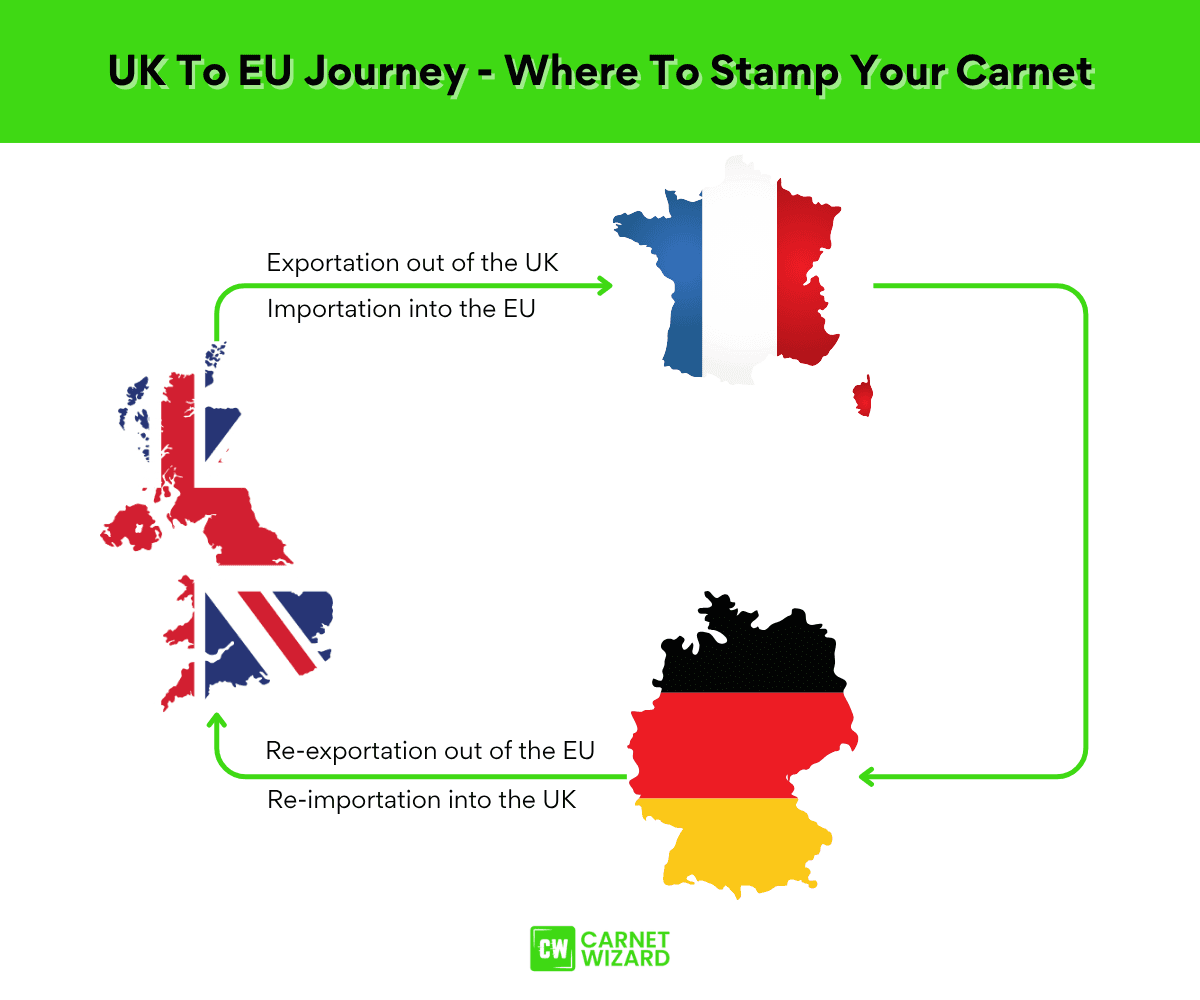

Where Do You Stamp Your EU ATA Carnet?

The ATA scheme considers the EU as a Single Customs Territory, which greatly simplifies the process. You only need a single ATA carnet to cover all 27 EU member states, and you do not have to validate your Carnet when you move between countries within the EU.

You must present the goods and the Carnet to Customs officials at four key points in your journey:

UK Export - at the UK port of exit, to officially register the goods leaving the UK (the yellow "Exportation" voucher)

EU Import - at the first EU port of entry (e.g. French customs), to officially register the goods entering the EU (the white "Importation" voucher)

EU Re-export - at the last EU port of exit (e.g. Germany, or any other EU country), to officially register the goods leaving the EU (the white "Re-Exportation" voucher)

UK Re-import - at the UK port of entry, to officially register the goods returning to the UK (the yellow "Re-Importation" voucher)

Please note that, if you travel to an EU country and then travel through a non-EU country before re-entering the EU, you will need to make sure all entrances and exits are recorded on your Carnet. This applies both to stopping in the non-EU country, as well as transiting through.

Transporting Goods To The EU? Carnet Wizard Can Help

Navigating the complexities of ATA Carnets post-Brexit shouldn't slow down your business. Carnet Wizard specialises in providing a fast, accurate, and digital-first service, ensuring your application is right the first time. We simplify the entire process so you can focus on your trip.

Save time and avoid customs headaches with our expert guidance - get started with your UK to EU Carnet today.

Carnet News for your inbox

Get the latest articles and insights delivered straight to your inbox. Sign up today to stay informed and ahead of the competition.

Fast Turnaround When You Need It Most With Carnet Wizard

The paperwork needed for a carnet can be overwhelming and complex, which is where carnet specialists come in. At Carnet Wizard, we pride ourselves on rapid services, where we dispatch a carnet within as little as a few hours.

From renewals and extensions to last-minute requests, talk to our professionals about your needs, and we’ll get right to it.

Support

Our friendly team is here to help.

Ask us anything

Phone

Mon-Fri from 9am to 5pm.

Sat-Sun Appointment Only